What takes a human analyst 30 days can now be completed by an AI agent in just 30 seconds—generating a 44-page, nearly 20,000-word credit report with one click. All data have been verified through a hallucination detector and include accurate source citations.

Today, East China Normal University’s SAIFS Research Center was officially inaugurated at Mosu Space! Multiple groundbreaking “AI + Finance” research achievements were announced on-site. Let’s take a look!

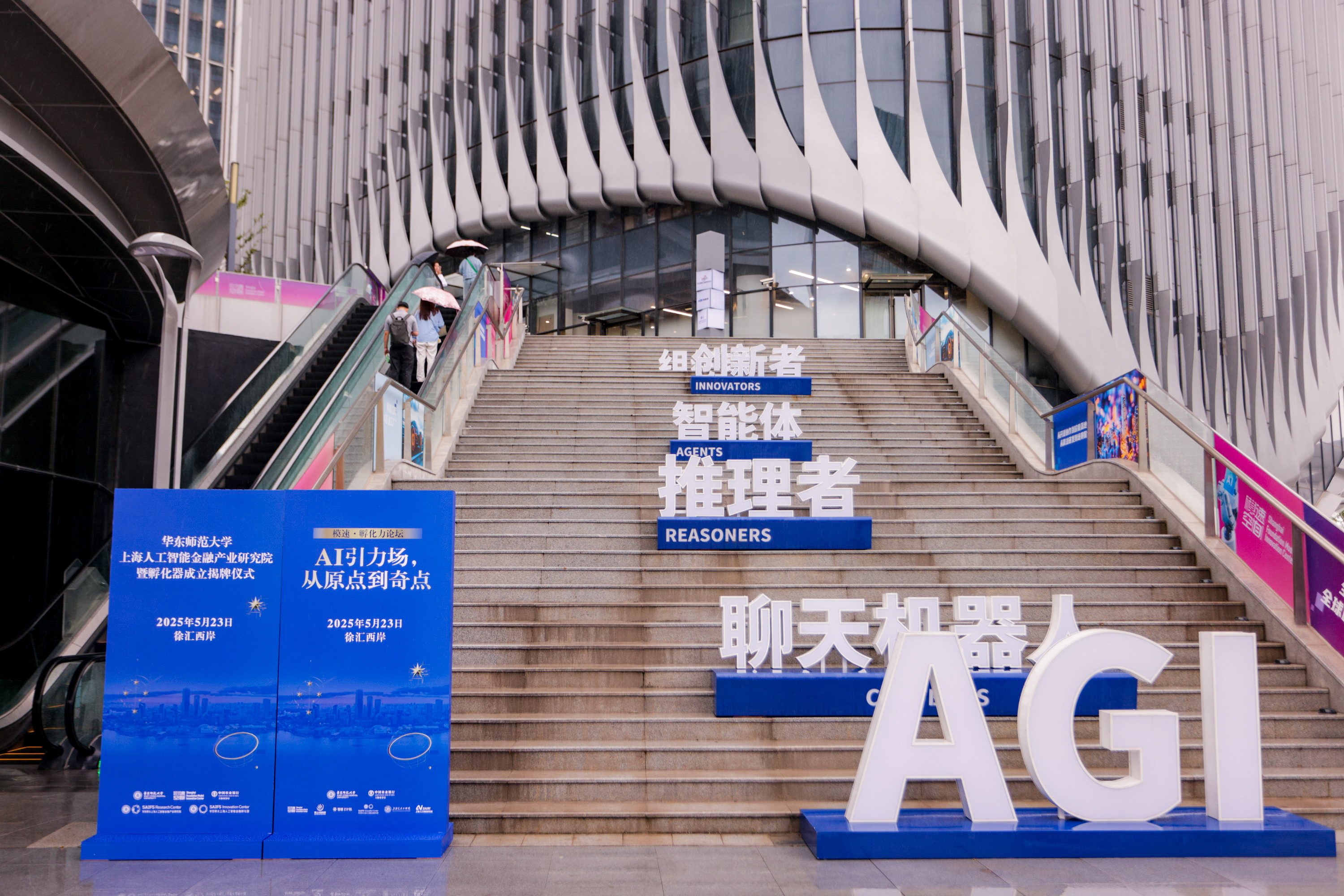

Guided by CPC General Secretary Xi Jinping’s important directives to “accelerate building a globally influential sci-tech innovation hub” and “strive to lead in all aspects of AI development and governance”, the inauguration ceremony of ECNU’s SAIFS Research Center was held at Mosu Space in Xuhui District on May 23.

Nearly 100 representatives from multiple sectors, including government, industry, academia, research, application, and finance, attended the event. Participants came from Shanghai Municipal Commission of Economy and Informatization, Shanghai Xuhui District Government, Agricultural Bank of China Shanghai Branch, East China Normal University, and other related enterprise incubators.

Together, they marked the beginning of a new chapter in the deep integration of AI and finance, injecting strong momentum into Shanghai’s development as an international financial hub and sci-tech innovation center.

The inauguration ceremony of ECNU’s SAIFS Research Center was held at Mosu Space

Mr. Cao Liqiang, Mr. Han Guoqiang, and Prof. Qian Xuhong jointly unveiled 3 major platforms

Mr. Cao Liqiang, Secretary of the Xuhui District Committee of Shanghai, Mr. Han Guoqiang, President of the Shanghai Branch of Agricultural Bank of China, and Prof. Qian Xuhong, President of ECNU, jointly unveiled 3 major platforms: the SAIFS Research Center, the “ECNU-Agricultural Bank of China Shanghai Branch” AI Finance Application Innovation Center, and the West Bund Joint Tech-Finance Laboratory.

This marks a collaborative effort among ECNU, Xuhui District, and the Agricultural Bank of China to jointly craft Shanghai’s blueprint for a virtuous cycle of “Technology-Industry-Finance”.

As ECNU’s first high-quality district-level incubator, the SAIFS Research Center has received strong support from Xuhui District. It focuses on the development of trusted finance vertical large language models, the creation of AI-driven financial demonstration scenarios, and the construction of a financial corpus, promoting deep integration of industry, academia, research, and application.

With the coordinated efforts of the Xuhui District government, Agricultural Bank of China Shanghai Branch, and ECNU, the incubator will accelerate building a full-chain closed loop of “FinTech LLM R&D → Scenario Validation → Industrial Transformation → Ecosystem Incubation”, powering Shanghai’s vision as a global financial technology hub.

|Tripartite Synergy: Government-Bank-University Alliance Anchors New Coordinates of National Strategy

As a concrete implementation of CPC General Secretary Xi Jinping’s important directives during his inspection of Shanghai, the establishment of the SAIFS Research Center marks a new stage in collaborative innovation among government, industry, academia, research, application, and finance.

Mr. Yu Linwei delivered a key speech

Mr. Yu Linwei, Member of the Standing Committee of Xuhui District Committee and Deputy District Head, emphasized that Xuhui, as a key hub of Shanghai’s sci-tech innovation center, has in recent years partnered with the municipal government to build the nation’s first large model innovation ecosystem community — Mosu Space. This has attracted over 1,000 AI enterprises to the district, laying a solid foundation for building a national AI highland and a world-class AI industrial cluster.This event signifies a new level of cooperation among the three parties. Xuhui District will deeply connect innovative resources from ECNU and the Agricultural Bank of China, upgrade the entire chain of the science and technology innovation system, accelerate the transformation of AI fintech achievements, and expects the collaboration platform to make key advances in core areas such as risk management and asset pricing.

Mr. Zhai Ji delivered a key speech

Mr. Zhai Ji, Deputy President of Agricultural Bank of China Shanghai Branch, stressed that as a key urban branch within the ABoC’s system, the Shanghai branch is committed to high-quality services supporting the construction of Shanghai’s “Five Centers”. It continuously deepens reforms and innovation, promotes the deep integration of finance and technology, and empower new quality productive forces with financial solutions.

Taking this inauguration as a new starting point, the branch will work with Xuhui District, ECNU, and society at large to build an “innovation community” covering “technology R&D – industrial scenarios – entrepreneurial incubation”, injecting fresh vitality and momentum into accelerating the development of the young field of artificial intelligence.

|Dual-Engine Drive of Technological Breakthrough and Scenario Implementation

At the ceremony, Prof. Shao Yilei, Director of the SAIFS Research Center, and her team, unveiled three core achievements.

Prof. Shao Yilei, Director of the SAIFS Research Center, unveiled three core achievements

First, the multimodal, hallucination-free, reasoning-enhanced financial reasoning large model “SmithRM” was introduced. Built on the embedded “Financial Reasoning Chain Database” and a “Policy-Industry-Company Multi-Source Multi-Modal Data Pool”, SmithRM provides an autonomous and controllable technical foundation for intelligent credit, financial analysis, and risk control scenarios.

Simultaneously, the FinAR Benchmark, a financial intelligence evaluation standard, was released to assess the comprehensive capabilities of various general and financial vertical large models in financial understanding, logical analysis, and fundamental judgment tasks. This evaluation system not only fills the gap in domestic quantitative assessment of financial reasoning abilities but also provides systematic references for regulators and financial institutions in selecting and deploying large models.

Second, the SAIFS-F4 family of financial intelligent agents (Finance 4) was launched, including AI Jason (Sirui, a financial analyst agent), AI Alex (Lvheng, a risk control and compliance governance agent), AI Jay (Guanwei, a political-economic macro analyst agent), and AI Emma (Zhiyuan, a data scientist agent). These agents will reconstruct the knowledge labor logic of the financial middle and back office, forming a “digital collaborator group” within the new intelligent financial system.

Mr. Wang Junlin (Jason), Deputy Director of the Financial Large Model Laboratory, demonstrated AI Jason

At the event, Mr. Wang Junlin (Jason), Deputy Director of the Financial Large Model Laboratory, demonstrated AI Jason, the financial analyst agent, completing in 30 seconds a credit report of a listed company spanning 44 pages and 18,947 words. All data in the report were verified by SAIFS’s hallucination detector, achieving zero hallucinations and including accurate data source citations. The demonstration highlighted three key features of AI Jason:

1. Speed: Work that takes a human analyst 30 days can be done by the AI in 30 seconds;

2. Accuracy: Zero hallucinations with 100% numerical correctness;

3. Explainability: Utilizing 100,000 finely annotated reasoning chain data entries, the model distills 15TB of industry, enterprise, policy reports, and due diligence data into SmithRM’s capability, enabling the generation of logically rigorous and interpretable credit reports.

Third, as an AI + finance demonstration scenario, the SAIFS Research Center and Agricultural Bank of China Shanghai Branch jointly built two flagship application scenarios: intelligent credit and intelligent macro analysis. Leveraging the SAIFS-F4 financial agent system, they realize a closed-loop of “data – models – agents – scenariso – learning feedback,” addressing the dual challenges of financial security and efficiency with “system-embeddable intelligent capabilities”.

|Building an Innovation Ecosystem to Cultivate New Quality Productive Forces

“The unveiling not only represents ECNU’s firm response to CPC General Secretary Xi Jinping’s earnest call to build a global science and technology innovation hub, but also demonstrates proactive commitment to Shanghai’s ‘Five Centers’ strategic development. Moreover, it embodies the university’s innovative practice in cultivating strategically needed talents through interdisciplinary advantages.” Prof. Meng Zhongjie, Deputy Party Secretary of ECNU, pointed out that the university will leverage the research center to focus on three strategic pillars:

1. Building a core technology stronghold by tackling fundamental fintech technologies and equipping financial security with a “Chinese lock”;

2. Innovating the integration model of industry and education by nurturing interdisciplinary talents driven by “discipline crossover + scenario application” and establishing a full-chain entrepreneurial incubation system;

3. Developing an evaluation system that balances innovation with ethics, exporting the “Shanghai experience” in AI governance.

Prof. Meng Zhongjie delivered a key speech

Mr. Bo Yapeng delivered a key speech

Mr. Bo Yapeng, Deputy Director of the Shanghai Municipal Commission of Economy and Informatization, emphasized that Shanghai will thoroughly implement CPC General Secretary Xi Jinping’s important directives, persistently supporting frontier AI innovation and industrial application, and continue to serve as the nation’s AI pioneer and leader. “We will accelerate the consolidation of AI foundational infrastructure, build ultra-large-scale intelligent computing power facilities, and improve the supply system for corpus data to better support AI application innovation.” He expressed high expectations that the SAIFS Research Center will seize the opportunities of AI development, accelerate R&D of trusted large-scale financial vertical models, build demonstration scenarios in the financial sector, develop innovative financial AI products, and deepen the application of AI in finance.

|Financial Vitality Nurtures the Fertile Soil of Sci-Tech Innovation

Mr. Zhu Weifeng released the “Ten-Point Measures for ABoC Shanghai's High-Quality Service to the AI Industry”

Mr. Zhu Weifeng, Deputy President of Agricultural Bank of China Shanghai Branch, simultaneously released the “Ten-Point Measures for ABoC Shanghai's High-Quality Service to the AI Industry”. The bank firmly regards supporting the AI industry as a strategic priority in serving national strategies, building a technology-finance service ecosystem based on “Government + ABoC + Supporting Services”, and pioneering a distinctive service model for AI enterprises integrating “Investment Banking + Commercial Banking + Transaction Banking”.

Concurrently, ABoC Shanghai launched the “Mosu Loan” product, implementing a “one park, one policy” batch-service model to prioritize funding for AI companies within Mosu Space.

|Global New Mission: Defining a Trustworthy Future for Intelligent Finance

In response to CPC General Secretary Xi’s earnest call to “take the lead in AI development and governance”, the mission manual of the SAIFS Research Center was unveiled on-site. Aiming at the deep integration of artificial intelligence and finance, the manual proposes constructing a tension field between technological breakthroughs (the North Star) and ethical bottom lines (the Southern Cross). This framework addresses major issues such as how scientific research can transform into trusted productive forces, how risk control can be embedded into intelligent foundations, how the financial system can respond to the voices of the “Global South,” how regulatory technology and ethical responsibility can collaborate, and how the talent structure can evolve from “technicians” to “coordinators”. While pursuing the scientific excellence symbolized by the North Star, it also ensures that the ethical coordinates represented by the Southern Cross safeguard the bottom line of human civilization, dedicated to creating an “Eastern solution” for Chinese-style modern financial governance.

“Mosu Incubation Power Forum” was held concurrently

Following the unveiling ceremony, the “Mosu Incubation Power Forum” was held concurrently, hosted by the SAIFS Research Center and Incubator, with joint support from Mosu Space, Shanghai Jiao Tong University Academy of Industrial Technology, Shanghai University Science Park, Shanghai Artificial Intelligence Institute, and Zhipu Z Plan.

Centered on the theme “AI Gravitational Field: From Origin to Singularity”, the forum gathered leaders from six major incubators and accelerators to jointly explore the construction and development paths of the entrepreneurial ecosystem in the AI era. The forum also released the “Stellar Blueprint”, projecting future trends of the AI startup ecosystem.

Sources: SAIFS Research Center, ECNU